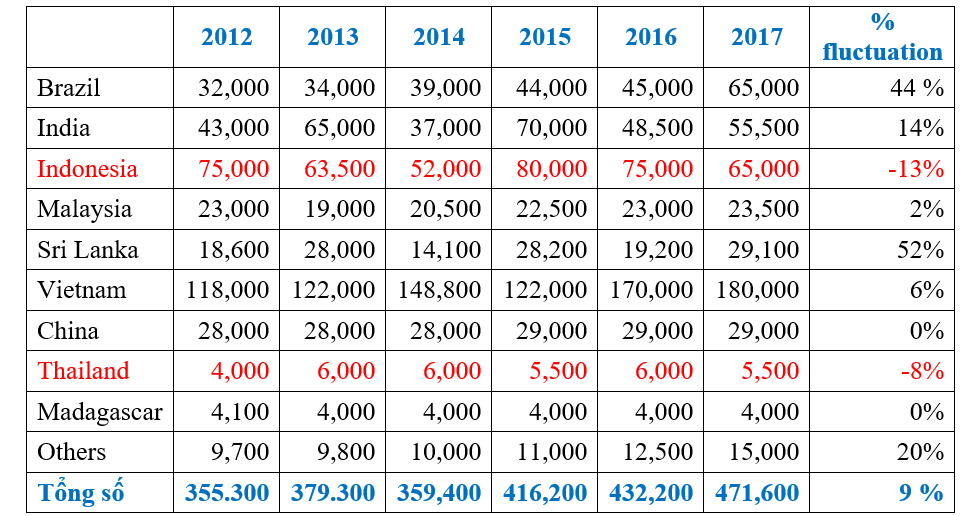

According to IPC, total global productions of pepper in 2017 approximated 472,000MTs which was 9% (~40,000MTs) higher than itself in 2016. Vietnam, Brazil, India and Sri Lanka were the origins which had their productions increased whereas Indonesia and Thailand were in the opposite situations.

Pepper production 2012-2017 (MTs)

(Source: IPC, 2017)

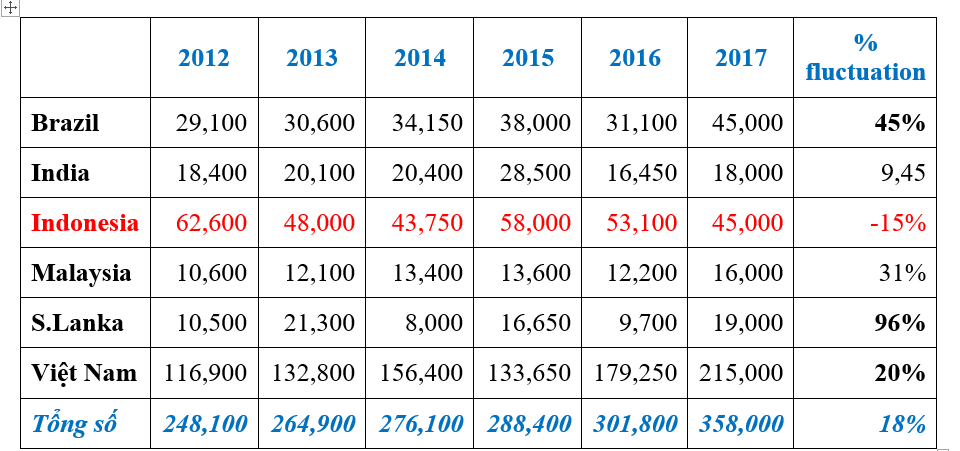

During 2012-2015, total export volume of top 6 exporting origins was growing 4-5% per annum on average. However, pepper export in 2017 was remarkably increasing in comparison with previous years which was historically recorded upto 18% of growth, specially thanked to Brazil, Vietnam and Sri Lanka.

Export growth of pepper 2012/2017

(Source: IPC, 2017)

Major pepper countries at a glance during 2017

* INDIA:

Production: In 2017, aproximated plantations area about 132,350 hectares (mostly mixed planting with other trees) which was more or less 600 hectares larger than itself in 2016. Production could be around 7,000MTs higher than itself in 2016. Forecast in 2018 said production might not be less than 2017.

Export: despite the production was growing well, the volume still not afforded both domestic consumption and export. Consequently India still had to import a great number of peppers from others in 2017. Pepper export from India was dropping to its lowest for last 5 years due to hard competitions from Brazil and Vietnam. In 2018, The Indian government has put some protective policies to secure the domestic production which obviously impact the pepper trades to/from India. Raw material at high prices for spices processing for export will put burdens to Indian manufacturers/exporters and make them less competitive to others.

* BRAZIL:

Production: it was recorded 65,000MTs crop size 2017 which was 20,000MTs higher than itself in 2016. Major pepper plantations located in Espirito Santo (ES) and Para (PA) states. During 2017, ES produced around 25,000MTS and estimated it could produce more up to 30,000MTs in 2018. Similar growth in PA: 30,000MTs in 2017 and expected 35,000MTs in 2018. Total production forecast for Brazilian pepper is about 75,000MTs.

Export: Brazil was at its best pepper export. Thanked to low production cost, Brazilian pepper had strongly competed Vietnamese pepper in 2017. All what were happening during Q1/2018 keep proving that Brazil is remaining its role as challenger to any producing country.

* CAMBODIA:

Production: Promptly grew during 2014-2016. In 2018 Total plantation area estimated at 6,600 hectares with a crop size up to 25,000-28,000MTs (against 20,000MTs itself in 2017)

Export/trade: mostly it is the raw quality traded through border with Vietnam (70%) and China, Thailand. These quantities are putting more pressures to Vietnamese pepper stocks during Q1/2018.

* INDONESIA:

Production: it was around 160,000 hectares for pepper plantation by 2017 in which 90,000 hectares located in Lampung and Bangka. Indonesia was said in bad crop during 2017 with a low productivity of 1.2MT per hectare. This produced only 68,000MTs which was 10,000MTs less than 2016. New crop will come shortly June/July 2018 but the production would probably be less than 2017 due to the narrower plantation areas, the lower prices of the market (which donot encourage farmers to intensively care of/invest on their farms.)

Export: considerably reduced in comparison with itself in 2016 (45,000MTs against 53,000MTs). Its largest import markets are Vietnam, US and India. There would be tough time for its export in the bottom falling market starting in 2018. Available offers new crop will be for Jun 2018 onward. Compliant to EU pesticide MRL would be a good selling point to compete.

* CHINA:

Production: mostly in Hainan and critically dropped from 29,000MTs in 2016 to 16,000MTs 2017. And the production forecast for 2018 is also not positive due to unfavorable weather conditions and the narrower planation areas.

Import/Consumption: China imported around 40,000MTs during 2017 (in which 14,570MTs was from Vietnam as highest ever). It used to forecast that the import growth in 2018 could be higher and it was true that during Q1/2018 China imported 7,000MTs against 2,900MTs Q1/2017 from Vietnam. This is quite promising and bullish factor to keep Vietnamese pepper from dropping too much.

* VIETNAM:

Production: plantation areas had expanded up to 152,000 hectares with a production estimated about 240,000MTs (~48% of the global production)

Market movements:

Domestic: very big fluctuations during 2017-2018 (prices were sliding from 133,000vnd/kg to 60,000vnd/kg). Crops were fully harvested by end Q1/2018 and productivity was recorded to be reduced seriously (30%-40%). The large expansion of plantation areas could some how make up the loss of productivity. However, in the long run, the production areas will definitely be adjusted/narrowed due to: 1) The increase of pest damage, uncontrollable quality of cultivation. 2) The market downfalls are discouraging the farmers to invest/re-invest on their pepper farms but switch to other trees.

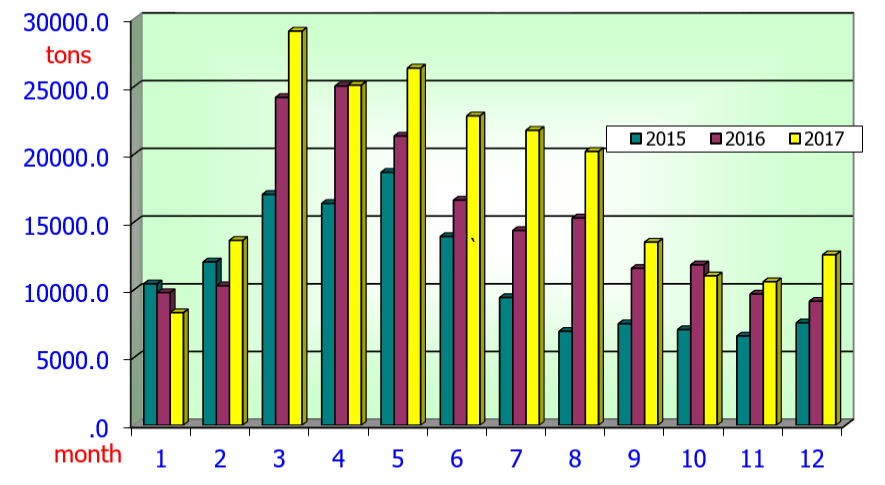

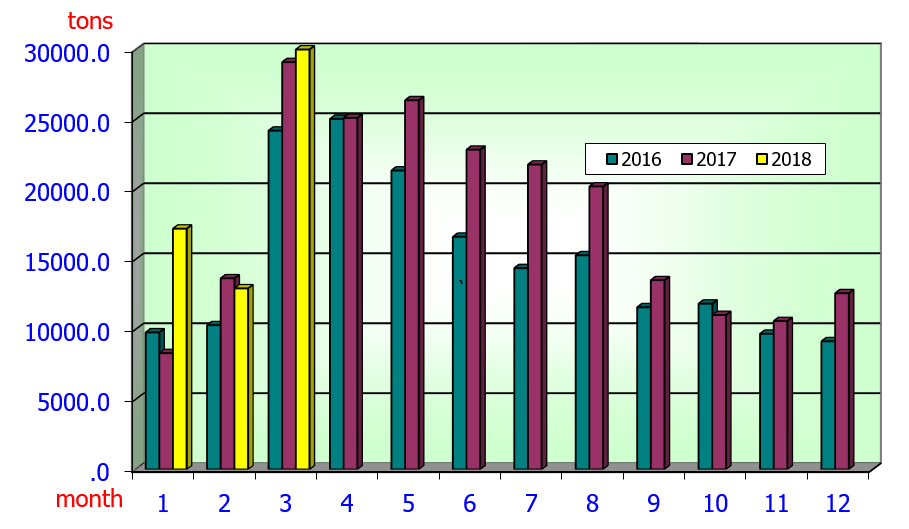

Export: Vietnam exported 215,081MTs during 2017 (increased 20% in term of export volume and decreased 22.20% in term of value in comparison with itself in 2016). In the first 3 months 2018 (Jan-Mar) Vietnam exported 60,179MTs. The records shown an increase 17.88% of volume but decrease of 31.20% of value.

EXPORT VOLUME 2015-2016-2017

EXPORT VOLUME 2016-2017-Q1/2018

Global import of pepper:

According IPC and ITC in 2017:

US was still the largest pepper import country of 80,000MTs, the 2nd largest was Germany (30,000MTs), UK and UAE imported 15,000MTs each. Netherland and Singapore imported more or less 6,000MTs.

OUTLOOKS:

The supplies from producing countries are steadily going uptrend during 2018. IPC has estimated a quantity of 103,000MTs to be carried over from 2017. Despite of a low productivity crop in 2018 from Vietnam -the largest pepper producing country, the global pepper production 2018 is still supposed to be 30,000MTs higher than itself in 2017.

With regards to the plentiful global supplies, especially from major pepper producing countries namely Vietnam, India, Brazil, Indonesia, Cambodia, the market trend would at least stay where they are and close to the bottom for few more years for the corrections of redundant stocks and plantation areas. Meantimes, the improvement of quality is utmost concerned.

(Source: VPA)